The field we now know as behavioral economics landed, if not incubated, at CASBS at two key moments in its roughly four-decades-and-running history.

One occurred through singular force of will and inspiration. The other was facilitated more through design and curation.

1977-78

The first took place during the field’s inception period, before it had a name or a group of adherents or practitioners. As an untenured professor with a precarious future, Richard Thaler had been compiling a list of human behaviors that deviated from the rational actor model used in standard economics. Thaler didn’t quite know what to do with this expanding list until meeting Baruch Fischhoff, a young scholar who studied decision making, at a conference in 1976. Fischhoff pointed Thaler to the work of two psychologists he worked with while pursuing his PhD at the Hebrew University in Israel – Daniel Kahneman and Amos Tversky. Thaler dug in immediately and read Tversky and Kahneman’s influential 1974 article, “Judgment under Uncertainty: Heuristics and Biases.” Among other things, the paper demonstrated the extent to which human errors are predictable and systematic. The take-home for Thaler was that such nonrandom errors (producing non-rational behavior) should be difficult to discount or wash-out in modeling (economic) decision making.

“The paper took me thirty minutes to read from start to finish, but my life had changed forever,” he writes in his 2015 book Misbehaving.

Thaler then devoured everything Kahneman and Tversky wrote together, and through connections obtained a draft-in-progress of a paper the two painstakingly had been crafting and refining for years. The final version, published in 1979 as “Prospect Theory: An Analysis of Decision under Risk,” has come to be regarded as a seminal achievement in social science.[i] It was completed during the 1977-78 academic year at the Center, when Kahneman was a CASBS fellow and Tversky had a visiting appointment at Stanford’s psychology department.[ii]

The moment was pivotal, as captured in Thaler’s book and two other high-profile books of recent years – Michael Lewis’s The Undoing Project and Kahneman’s Thinking, Fast and Slow. The article was a frontal assault to expected utility theory, a bulwark of economics for decades. Prospect theory elucidated a formal “value function” that expressed variation in preferences for personal gains and losses – exhibited through multiple, repeated psychology experiments – in a way that reflected human nature much more realistically.

According to Lewis, Thaler instantly recognized that the paper “blew a hole in economic theory for psychology to enter.” It wholly justified how Thaler was thinking and feeling. Misbehaving devotes a chapter to the paper’s insights,[iii] which basically explained the logic underlying Thaler’s list, leaving him “flabbergasted” and exhilarated.

What followed commands the status of social science legend. Aware that Kahneman and Tversky would be spending the 1977-78 academic year at CASBS and Stanford, respectively,[iv] Thaler convinced renowned health economist Victor Fuchs, then director of the National Bureau of Economic Research (NBER) office occupying the same hill as CASBS, to offer him an appointment at NBER.[v]Fuchs ultimately arranged the first meeting with Kahneman and Tversky, which subsequently gave Thaler “license to walk up the hill and drop in on Danny,” though he sometimes found the two psychologists fine-tuning prospect theory together. As Thaler recounts in Misbehaving,

Danny and I soon began the habit of taking walks in the hills near the Center just to talk. We were equally ignorant and curious about each other’s fields, so our conversations offered many learning opportunities. One aspect of these mutual training sessions involved understanding how members of the other profession think, and what it takes to convince them of some finding.

Pages later, Thaler reveals that “at some point during my year in Stanford I decided I was going ‘all in’ on this new venture” – the study of how (mis)behavior influences the study of market economics.[vi]

And there’s the origin. Kahneman concisely summed-up the significance of the encounters and the audacious, “deviant” venture it spawned:

CASBS is where behavioral economics took shape. When Richard Thaler heard that Amos Tversky and I would be in Stanford, he finagled a visiting appointment down the hill to spend time with us. We spent a lot of time walking around the Center and became lifelong friends. Those long conversations that Dick had with Amos and me helped him construct his then heretical (and now well-established) view of economics, by using psychological observations to explain violations of standard economic theory.[vii]

From there, as Misbehaving chronicles with flair, Thaler observed, accumulated insights, attracted collaborators, published, pushed, battled, pushed harder and, ultimately, established himself as the central figure of a new field within economics.

In 2017, Richard Thaler won the Nobel Prize in economics[viii] for “his contributions to behavioural economics.” A few days later, asked to reveal his biggest discovery, he naturally replied, “Greatest by far was discovering the work of Danny Kahneman and Amos Tversky.”[ix]

* * *

From those dramatic beginnings the hard work of field-building depended on behavioral economics exploring new phenomena and areas of inquiry, as well as dispersing and flourishing among a wide array of people, programs, and universities. And it did. Thaler figures prominently throughout, but increasingly so does a growing cadre of scholars that he and others helped cultivate or inspire. For the next two decades and beyond there is a great deal of credit shared among a number of proud intellectual mothers and fathers. This includes the support of institutions. Notably, the Russell Sage Foundation is well known to have propelled the field forward during the 1983-85 period, continuing in later years through sponsorship of biannual summer institutes.

1997-98

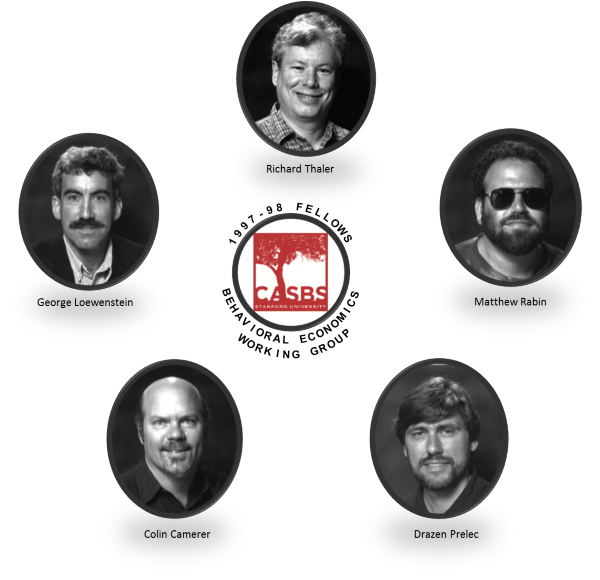

For several years running, starting in the early 1990s, CASBS attempted to bring a working group of behavioral economists and psychologists on the hill together as fellows. Eventually, schedules aligned for the 1997-98 academic year, by which time behavioral economics was advancing rapidly.[x] The group was anchored by rising stars in the field – Colin Camerer, George Loewenstein, Drazen Prelec, and Matthew Rabin – as well as Richard Thaler.[xi] Their friendships and collaborations already had been overlapping for years. What can we say about this convergence, at this place? Did it help the field – or new avenues of inquiry emanating from it – accelerate forward?

An end-of-year Behavioral Economics Working Group report submitted to CASBS in July 1998 describes weekly group meetings to discuss paper drafts and other works-in-progress, brainstorm new research ideas, and take stock of developments in the field.

What are the big ideas? What sorts of data or tools are necessary to move ahead? In what areas of economics does “getting the psychology right” make the largest difference? The consensus that emerged – and, of course, agreement to disagree on some matters – promises to chart our own research, and the research of collaborators and students, for the next several years and beyond.[xii]

The five arrived with individual projects and agendas. Camerer, notably, wrote 300 pages of what would become his groundbreaking and widely-cited book, Behavioral Game Theory, published in 2003.[xiii] A copy of the book resides in the Center’s Ralph W. Tyler Collection.

But they also “cooked-up collaborations,” as Loewenstein puts it, which were pursued while in residence together (and well beyond). “The papers that emerged from that year, including some very influential ones, certainly number in the double-digits,” he recalls. “This was a seminal year for many of us, and for the field as a whole.”[xiv]

Upon re-examining that working group report, Camerer marvels at “an amazing number of important papers that were either incubated or finished there.”

So the CASBS year is like a time-lapse video, probably tripling the completion speed of a lot of papers. Virtually all of these became foundational for aspects of behavioral economics for the next ten years. It meant that by 1998 or 2000 one could teach a PhD course in behavioral economics and have a lot of good papers to teach from… That wasn’t so true in, say, 1994.[xv]

While the quantity and significance of the research undertaken and reported by the group in 1998 is difficult to dispute,[xvi] what about the hindsight view? Is there anything about the 1997-98 fellowship year that sticks-out now, exactly 20 years after the group descended upon CASBS, that wasn’t evident or visible on the landscape at the time?

Yes. Richard Thaler points to the last few pages of a mammoth-length paper (co-authored with Cass Sunstein and Christine Jolls) completed at CASBS, “A Behavioral Approach to Law and Economics.”[xvii] In its final pages the authors argue that a limit to rationality “pushes toward a sort of anti-antipaternalism” – skepticism toward “reflexive anti-paternalism,” or the notion that consumers are always the best judges of what choices will advance their own welfare. In addition, there is agreement that the paper, combined with a related line of research by Camerer, Loewenstein, Rabin, and collaborators whose ideas underwent initial incubation at CASBS (eventually published as “Regulation for Conservatives: Behavioral Economics and the Case for ‘Asymmetric Paternalism’) teed-up a lot of talk about paternalism at CASBS for the remainder of the academic year, resulting in a cascade of extensions and new contributions to the literature for years.[xviii]

“There were lots of discussions about paternalism,” says Thaler. That’s what I most remember. In my mind that’s the most important thing that came out of that year collectively. I do think the endless conversations played an important role in pushing the field forward.”

Moreover, says Thaler, the 1998 paper and associated research emerging in that space “provided a path to ‘libertarian paternalism,’ which was the main idea in Nudge.”[xix] That best-selling book, of course, propelled Thaler – and others – out of the realm of theory, experimentation, and the nuts and bolts of field-building and into public policy applications.[xx]

“The influence of behavioral economics on public policy, alone, has been enormous,” adds Loewenstein. I don’t think that would have happened, at least in the way it did, if we hadn’t interacted at CASBS.”

Matthew Rabin wrote and circulated the first draft of an influential paper, later published in Econometrica, on “calibrating” expected utility theory. The paper was the first to effectively capture a gathering intuition that risk aversion could not be explained the way most economists had claimed for years, if not decades.[xxi]

Colin Camerer and Drazen Prelec point to a fertile new line of research (in collaboration with George Loewenstein and others), launched in a concerted way in 1997, into an area now well known as neuroeconomics (or decision neuroscience in some circles). The “roots” of a landmark 2005 article in the Journal of Economic Literature, according to Prelec, extend back to the CASBS year.[xxii]

Prelec, in addition, spent much of 1997-98 breaking new ground in precisely defining and formalizing a specific behavioral economic model of “self-signaling” – psychological mechanisms that motivate interaction between two parallel, co-existing selves. Though his efforts elaborated upon initial research appearing in a co-authored chapter of collaborator Ronit Bodner’s 1995 unpublished PhD dissertation, Prelec’s CASBS work resulted in drafts (discussed and circulated among CASBS working group members) of what would become the first two publications devoted to self-signaling.[xxiii]

“Overall, this and associated work has had considerable impact, and has helped establish an accelerating research area,” says Prelec. “Though self-signaling is not yet part of the behavioral economics ‘canon,’ that is changing. I believe it has the potential to explain many mysteries associated with collective action, self-control, morality, shame, and guilt.”

* * *

As noted, by 1997-98 new lines of inquiry already were expanding the field’s foundational work and ongoing institutional and geographic proliferation. Accordingly, with some research advances we would expect to encounter what Prelec calls a “temporal credit assignment problem.” The sensible principle behind it simply is that great ideas typically take a long time to incubate – “on the order of half-decades or decades,” says Camerer, thus allowing the welcome insights of lots of those intellectual mothers and fathers into the mix.[xxiv] Taking neuroeconomics as an example,

We definitely were thinking about the brain at CASBS in 1997. But like microwave popcorn that is silent for a couple of minutes, the work did not emerge until 7-8 years later and then accelerated. The metaphor is like seeds that take a long time to sprout to a first crop.[xxv]

Indeed, though a core group of five fellows were members of the Center’s Behavioral Economics Working Group, in the bigger picture it’s clear from their July 1998 report that they considered their time at CASBS a big success in large part because of the wider community in which they participated while on the hill. (Richard Thaler suggests likewise throughout Misbehaving, invoking a huge cast of vital characters throughout the book – including 33 former CASBS fellows.) The working group hosted 13 outside speakers – including Daniel Kahneman – from places as nearby as Stanford and Berkeley and as far away as Switzerland. They also benefited from extended visits by graduate students (including a month-long stay by then-grad student Dan Ariely), informal lunchtime discussions with guest scholars, and a dizzying number of long-distance working relationships.[xxvi]

The real story, then – whether in 1978 or 1998 (or 2018, for that matter) – is CASBS as a focal point and greenhouse of sorts, fueling interactions that facilitate collaborations, synergies and, ideally, new ways of thinking and researching. In the case of behavioral economics, this happened across disciplinary barriers as well as professional networks in the service of discovery, field-building and, eventually, public policy impact.

CASBS thanks Colin Camerer, George Loewenstein, Drazen Prelec, Matthew Rabin, and Richard Thaler for their generous participation and comments.

All photos: CASBS files. Graphics: Ravi Shivanna

- Camerer, Colin (2003). Behavioral Game Theory: Experiments in Strategic Interaction. Princeton University Press.

- Kahneman, Daniel (2011). Thinking, Fast and Slow. Farrar, Straus and Giroux.

- Kahneman, Daniel, and Amos Tversky (1979). “Prospect Theory: An Analysis of Decision under Risk,” Econometrica Vol. 47, No. 2: 263-292.

- Lewis, Michael (2016). The Undoing Project: A Friendship that Changed our Minds. W.W. Norton.

- Thaler, Richard H. (2015). Misbehaving: The Making of Behavioral Economics. W.W. Norton.

- Thaler, Richard H., and Cass R. Sunstein (2009). Nudge: Improving Decisions About Health, Wealth, and Happiness. Penguin Random House.

- Tversky, Amos and Daniel Kahneman (1974). “Judgement under Uncertainty: Heuristics and Biases,” Science Vol. 185, Issue 4157: 1124-1131.

[i] Indeed, the article is widely viewed as the cornerstone of a body of work that earned Kahneman the Nobel Prize in economics in 2002. Tversky would have shared the prize had he not passed away in 1996.

[ii] Tversky, incidentally, was a CASBS fellow during the 1970-71 academic year.

[iii] The descriptions here oversimplify, so the book is well worth the read. But Thaler, who proclaims himself a “lazy man” at several points, would forgive the reader for instead starting with an adaptation of his Nobel Prize lecture. Thaler, Richard H., “Behavioral Economics from Nuts to ‘Nudges’,” Chicago Booth Review, 7 May 2018.

[iv] CASBS was an independent research center, leasing Stanford land, from its inception in 1954 until its merger with the university in 2008.

[v] Fuchs himself was a CASBS fellow in 1972-73 and returned for a second CASBS fellowship in 1978-79. Fuchs is among four people to whom Thaler dedicates Misbehaving.

[vi] Reached by phone, Thaler affirms that “1977-78 was the most important year of my life. I decided I was going to do this – this thing that didn’t exist.” Phone interview with Richard Thaler, 3 April 2018.

[vii] Daniel Kahneman email communication with CASBS director Margaret Levi, 20 May 2016.

[viii] Appelbaum, Binyamin, “Nobel in Economics is Awarded to Richard Thaler,” New York Times, 9 October 2017. View the Nobel announcement by the Royal Swedish Academy of Sciences here.

[ix] Sommer, Jeff, “Richard Thaler Talks About Silly (but Serious) Things,” New York Times, 13 October 2017.

[x] The organizing theme of early attempts to bring the group to CASBS involved a “Special Project on the Behavioral Economics of Labor Supply,” parts of it sometimes casually referred to as the “effort project.” By the time the group actually convened at the Center in 1997, however, a lot of work in this vein had been conducted by its members and their collaborators, trickling its way into the literature or the publication pipeline. A well-known example described in Misbehaving is Camerer, Colin; Babcock, Linda; Loewenstein, George; Thaler, Richard H. (1997), “Labor Supply of New York City Cabdrivers: One Day at a Time,” The Quarterly Journal of Economics, Vol. 112, Issue 2: 407-441. See also Camerer, Colin, and Robin Hogarth, (1999), “The Effects of Financial Incentives in Experiments: A Review and Capital-Labor-Production Framework,” Journal of Risk and Uncertainty, Vol. 19, Issue 1-3: 7-42.

[xi] Thaler was a fellow at CASBS only for the second half of the academic year. He also dedicates Misbehaving to Camerer and Loewenstein, “early students of misbehaving.” Thaler credits Camerer for “more or less invent[ing] the field of behavioral game theory” and for being “at the forefront of neuro-economics…” Among economists in the field, Thaler asserts that only Loewenstein “has really created much new psychology.” And in his Chicago Booth Review piece, Thaler calls Rabin “the most important behavioral-economics theorist of his generation.”

[xii] Behavioral Economics Working Group, report to the Center for Advanced Study in the Behavioral Sciences, 8 July 1998 (CASBS files).

[xiii] “Now I think it’s got the status of something that people cite without even having read it, which is kind of great in a way,” muses Camerer. Colin Camerer email communication with CASBS, 9 April 2018. The book’s acknowledgments note that “It was supported by a wonderful year at the Center for Advanced Study in the Behavioral Sciences in 1997-98. (Is it possible to have a bad year there? It poured rain the whole time and it was still fun.)” Richard Thaler separately notes – correctly – that 1997-98 was an unrelenting El Niño year, with 20 rainy days in February alone (tying the 1915 record), partially accounting for the group’s incredible productivity. Phone interview with Richard Thaler, 3 April 2018.

[xiv] George Loewenstein email communication with CASBS, 10 February 2018. As one example, an important line of research by Loewenstein, Rabin, and collaborator Ted O’Donoghue on bias in predicting future preferences did not see first publication until 2003, though the work began at CASBS. Loewenstein, George, O’Donoghue, Ted, and Matthew Rabin, (2003), “Projection Bias in Predicting Future Utility,” The Quarterly Journal of Economics, Vol. 118, No. 4: 1209-1248. The authors note: “This research was started while Loewenstein and Rabin were Fellows at the Center for Advanced Study in the Behavioral Sciences…and they are grateful for the Center’s hospitality…” “We especially thank Colin Camerer and Drazen Prelec for very helpful discussions at the formative stages of this project.” With this paper, Rabin credits Loewenstein for landing “on something big, and working that out with him and basically rendering his brilliant and insightful ideas into economic theory was a key part of my own development…” Matthew Rabin email communication with CASBS, 14 June 2018.

[xv] Colin Camerer email communication with CASBS, 9 April 2018.

[xvi] View an excerpt of the 1997-98 Behavior Economics Working Group report, with links to publications, here.

[xvii] Sunstein, Cass, Jolls, Christine, and Richard H. Thaler, (1998), “A Behavioral Approach to Law and Economics,” Stanford Law Review, Vol. 50:1471-1550. In Misbehaving, Thaler notes that the part of the article devoted to paternalism “got people’s blood boiling.”

(The present article, be assured, has been scrubbed of all hindsight bias...)

[xviii] Phone interview with Richard Thaler, 3 April 2018; George Loewenstein follow-up email communication with CASBS, 10 April 2018. Colin Camerer email communication with CASBS, 1 May 2018. Loewenstein points to Matthew Rabin in particular as a major catalyst for these discussions. Camerer, Colin, Issacharoff, Samuel, Loewenstein, George, O’Donoghue, Ted, and Matthew Rabin, (2003), “Regulation for Conservatives: Behavioral Economics and the Case for ‘Asymmetric Paternalism’,” University of Pennsylvania Law Review, Vol. 151, Issue 3: 1211-1254.

[xix] Phone interview with Richard Thaler, 3 April 2018. See also Sunstein, Cass, and Richard H. Thaler, (2003), “Libertarian Paternalism is Not an Oxymoron,” The University of Chicago Law Review, Vol. 70, No. 4: 1159-1202; Thaler, Richard H., and Cass Sunstein, (2003), “Libertarian Paternalism,” American Economic Review, Vol. 93, No. 2: 175-179. Rabin agrees the CASBS year was “formative in terms of some of the notions of cautious paternalism and choice architecture.” Matthew Rabin email communication with CASBS, 18 June 2018.

[xx] Thaler notes in his Chicago Booth Review article that while his research interests always had been based on public policy questions, his venture combining psychology and economics “deliberately stayed away from policy issues. I did so because I wanted behavioral economics to be perceived as primarily a scientific rather than political enterprise.”

[xxi] Rabin, Matthew, (2000), “Risk Aversion and Expected-Utility Theory: A Calibration Theorem, Econometrica, Vol. 68, No. 5, 1281-1292. Richard Thaler was “super supportive” of the paper’s insights, and the two later co-authored an article in Thaler’s popular “Anomalies” series based on it. Matthew Rabin email communication with CASBS, 14 June 2018. See Rabin, Matthew, and Richard H. Thaler, (2001), “Anomalies: Risk Aversion,” Journal of Economic Perspectives, Vol. 15, No. 1, 219-232.

[xxii] Phone interview with Drazen Prelec, 2 May 2018. See Camerer, Colin, Loewenstein, George, and Drazen Prelec, “Neuroeconomics: How Neuroscience Can Inform Economics,” (2005), Journal of Economic Literature, Vol. 43, No. 1: 9-64. Also Camerer, Colin, Loewenstein, George, and Drazen Prelec, (2004), “Neuroeconomics: Why Economics Needs Brains,” Scandinavian Journal of Economics, Vol. 106, No. 3: 555-579. Both papers acknowledge the support of CASBS during 1997-98. Camerer also points to an influential paper by Loewenstein and collaborators, appearing in Science in 2004, “Separate Neural Systems Value Immediate and Delayed Monetary Awards,” whose origins trace back to 1997.

[xxiii] Phone interview with Drazen Prelec, 2 May 2018; Prelec email communications with CASBS, 6 June 2018, 10 June 2018, 12 June 2018. In pursuing this line of research, Prelec also credits discussions with and theoretical questions raised by philosopher and 1997-98 CASBS fellow Michael Bratman. The two publications referenced are Bodner, Ronit, and Drazen Prelec, (2003) “Self-signaling and Diagnostic Utility in Everyday Decision-making,” in Isabelle Brocas and Juan D. Carrillo, eds., The Psychology of Economic Decisions, Vol. 1: Rationality and Well-being, Oxford University Press; Prelec, Drazen, and Ronit Bodner, (2003) “Self-signaling and Self Control,” in George Loewenstein, Daniel Read, and Roy F. Baumeister, eds., Time and Decision: Economic and Psychological Perspectives on Intertemporal Choice, Russell Sage Foundation. Prelec further notes that the self-signaling model is a specific variant of a “dual-self” model. Thaler discusses one such dual-self model (not involving self-signaling), the “planner-doer model,” at length in Misbehaving. Thaler, Richard H., and H.M. Shefrin, (1981), “An Economic Theory of Self-control,” Journal of Political Economy, Vol 89, No. 2: 392-406.

[xxiv] Phone interview with Drazen Prelec, 2 May 2018. Colin Camerer email communication with CASBS, 1 May 2018. With self-signaling, for example, Prelec points to similar work published by economists Roland Bénabou and Jean Tirole. “We were independently working-out models that, in the end, had quite strong resemblance, technically. We became aware of this sometime soon after the CASBS year.” Drazen Prelec email communication with CASBS, 12 June 2018. See Bénabou, Roland, and Jean Tirole, (2004), “Willpower and Personal Rules,” Journal of Political Economy, Vol. 112, No. 4: 848-886.

[xxv] Colin Camerer email communication with CASBS, 1 May 2018. Indeed, in characterizing the 1997-98 CASBS year overall, Camerer, a master of metaphor, notes “there is a lot to be proud of but it was like a pudding very slowly getting cooked rather than a rocket ship taking off or an ‘aha’ moment.” Colin Camerer email communication with CASBS, 9 April 2018. Rabin refers to the year as “gradual incubation; we each brought ideas to the Center in inchoate form, which got sharpened by the others.” Matthew Rabin email communication with CASBS, 14 June 2018.

[xxvi] Behavioral Economics Working Group, report to the Center for Advanced Study in the Behavioral Sciences, 8 July 1998 (CASBS files). Besides Kahneman, other outside speakers included Anthony Bastardi, Warren Bickel, Iris Bohnet, John Gabrielli, Chip Heath, Christopher Hsee, Mark Kleiman, Robert Levensen, Robert MacCoun, Felix Oberholzer-Gee, Jonathan Schooler, and Peter Ubel. Other 1997-98 CASBS fellows who gave presentations to the group included Paul Baltes, Mark Bouton, Shelly Chaiken, and Susan Mineka. In communications to discuss this article, both Colin Camerer and Richard Thaler separately called-out CASBS fellow Mitch Polinsky for playing the indispensable role of sounding board and, in some cases, a referee of sorts. Camerer also acknowledges valuable exchanges with CASBS fellow David Barlow; fruitful lunch visits with Singaporean economist Ho Teck-Hua (during which they made significant progress on a paper about ‘experience-weighted attraction learning,’ published in 1999 in Econometrica, that was well cited and planted seeds for future collaborations), and other enlightening lunch discussions, one in particular with Stanford economist Paul Milgrom. Besides Ariely (now at Duke University), the graduate students were Roberto Weber (now at University of Zurich), Shane Frederick (Yale University), and Ned Welch (McKinsey & Co.).